Mehrteab Leul & Associates

Legal Update on Limit on Foreign Currency Holding in the Territory of Ethiopia

Introduction

The National Bank of Ethiopia (NBE) has introduced a Limit on Birr and Foreign Currency Holding in the Territory of Ethiopia Directive (“New Directive”) which repealed and replaced the previous directive regulating the matter, Directive No. FXD/49/2017, effective from September 5, 2022. We have prepared this short legal update to give our clients an overview of the main change brought by the New Directive.

On Foreign Currency Holding and Timeline Limit for Incoming Individuals (through air transportation)

Resident person in Ethiopia entered into the territory of Ethiopia should convert all the foreign currency they hold at authorized forex bureau or deposit to their foreign currency account, if they have, within one month from the date of entry. If the amount exceeds US$ 4000, they have to present customs declaration.

Diasporas and Ethiopian who are non-resident and intended to stay in Ethiopia for more than three months should transfer all the foreign currency they hold to their non-resident foreign currency account or foreign exchange saving account within three months from the date of entry. If the amount exceeds US$ 10,000, however, they have to present custom declaration.

Foreigners who are not residing in Ethiopia can hold the amount of foreign currency they hold without restriction until the expiration of their visa.

On Foreign Currency Holding and Timeline Limit for Outgoing Individuals (through air transportation)

A person residing in Ethiopia can travel aboard with foreign currency purchased from the bank within one month from the date of a bank advice. Non-resident diaspora and Ethiopian nationals who are not residing in Ethiopia can travel aboard with foreign currency either purchased from the bank within one month from the date of a bank advice or if they enter the country and leave within three months. If the amount exceeds US$ 10,000, they have to present customs declaration.

Embassy and international institutions’ employees, trainers and workshop participants who enter the country can hold more than US$ 10,000 if they provide either bank advice or employer’s letter or supporting letter that justify the acquisition of the foreign currency is from a legal source.

On Foreign Currency Holding and Timeline Limit for Incoming Individuals (through inland transportation)

A person entering into the territory of Ethiopia through in land transportation should declare at the board if they hold other foreign currency which have equivalent or more than US$ 500.

On Birr Holding Limit for Incoming and outgoing Individuals

Any person entering to and departing from Ethiopia can hold up to ETB 3000 per travel. However, travel from and to Djibouti can hold up to a maximum amount of ETB 10,000 per travel.

On Prohibited Transactions

Unless as provided in this New Directive or other laws, it is prohibited to hold foreign currency. It is also prohibited to undertake any transaction in foreign currency. Therefore, the New Directive prohibits to pay foreign currency in cash to a third party either to discharge a contractual or other obligations or by way of gift and/or donation unless as provided the New Directive, other laws or without prior authorization of the NBE. Any person who acquired foreign currency by means of donation and/or gift before the coming into effect of the New Directive should convert the currency s/he received to Ethiopian birr within one month therefore until October 05, 2022.

Disclaimer: This information is intended as a general overview and discussion of the subjects dealt with. The information provided here was accurate as of the day it was posted; however, the law may have changed since that date. This information is not intended to be, and should not be used as, a substitute for taking legal advice in any specific situation. Mehrteab & Getu Advocates LLP is not responsible for any actions taken or not taken on the basis of this information. Please refer to the full terms and conditions on our website.

Copyright©2022 Mehrteab & Getu Advocates LLP. All rights reserved.

The National Bank of Ethiopia’s New Directive on Retention and Utilization of Foreign Currency Earnings from Export and Inward Remittance (06 January 2022)

The National Bank of Ethiopia (“NBE”) issued a new directive (Directive No. FXD/79/2021) governing the retention and utilization of foreign currency earnings from export and inward remittance. Previously the area was regulated by the Directive No. FXD/73/2021 (“Old Directive”). In this edition of our legal update, we have tried to look in to the changes introduced by the New Directive preceded by a highlight on the changes made by the series of directives of NBE governing the area.

The National Bank of Ethiopia (“NBE”) issued a new directive (Directive No. FXD/79/2021) governing the retention and utilization of foreign currency earnings from export and inward remittance. Previously the area was regulated by the Directive No. FXD/73/2021 (“Old Directive”). In this edition of our legal update, we have tried to look in to the changes introduced by the New Directive preceded by a highlight on the changes made by the series of directives of NBE governing the area.

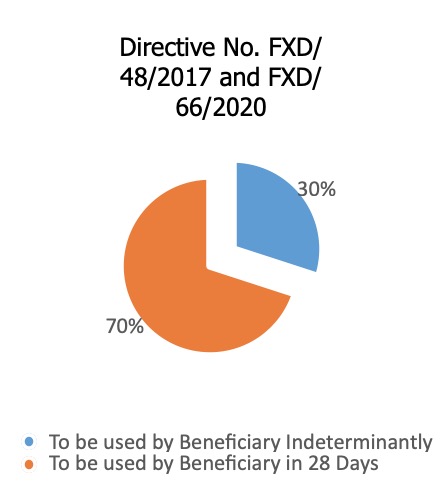

For three years, this part of the foreign currency management regimes of NBE was regulated by the Retention and Utilization of Export Earnings and Inward Remittance Directive No. FXD/48/2017 that entered in to force on 3 October 2017 and was effective until replaced by the Retention and Utilization of Export Earnings and Inward Remittance Directive No. FXD/66/2020 that entered in to force as of the 16 September 2020. The later Directive introduced minor changes regarding credit of funds in retention accounts for local merchants or entities licensed by NBE and the manner of using foreign currency available in Retention account A and B. Under both these directives, an exporter or a foreign currency remittance beneficiary had the right to maintain 30% of the foreign currency earnings in Retention Account A for indefinite period of time and the remaining 70% would be retained in Retention Account B for a period of 28 days and before the lapse of the 28 days it was possible to use the currency for importing specified items.

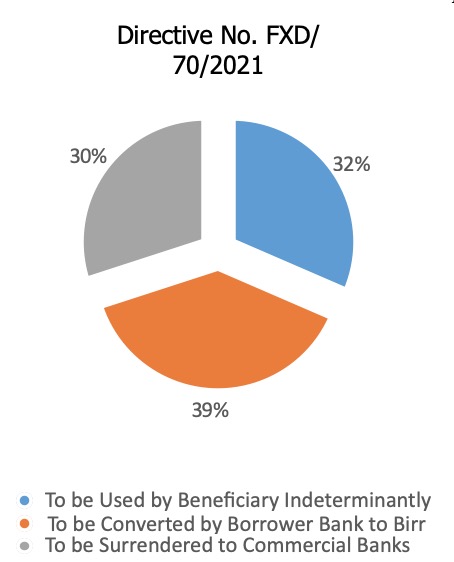

NBE issued Directive No. FXD/70/2021 by repealing Directive No. FXD/66/2020. Directive No. FXD/70/2021 entered in to force as of 09 March 2021. This Directive brought about significant changes by, among others, eliminating the Retention Account “A” and Retention Account “B” and recognizing only one Forex Retention Account, establishing a mandatory surrender requirement where all the beneficiaries are required to surrender 30% of the foreign currency earning to NBE, and reduced the amount of proceeds to be retained in the retention account to 45% (of the remaining currency after the surrender) and it required the sale of 55% (of the remaining currency after the surrender) of the foreign currency earning to the banks immediately on the day of receipt at the prevailing buying exchange rate. It also changed the requirements for utilization of the foreign currency permitting beneficiaries to use the foreign exchange for the importation of goods and services without restriction as long as it has a business license to import these goods and services.

NBE issued Directive No. FXD/70/2021 by repealing Directive No. FXD/66/2020. Directive No. FXD/70/2021 entered in to force as of 09 March 2021. This Directive brought about significant changes by, among others, eliminating the Retention Account “A” and Retention Account “B” and recognizing only one Forex Retention Account, establishing a mandatory surrender requirement where all the beneficiaries are required to surrender 30% of the foreign currency earning to NBE, and reduced the amount of proceeds to be retained in the retention account to 45% (of the remaining currency after the surrender) and it required the sale of 55% (of the remaining currency after the surrender) of the foreign currency earning to the banks immediately on the day of receipt at the prevailing buying exchange rate. It also changed the requirements for utilization of the foreign currency permitting beneficiaries to use the foreign exchange for the importation of goods and services without restriction as long as it has a business license to import these goods and services.

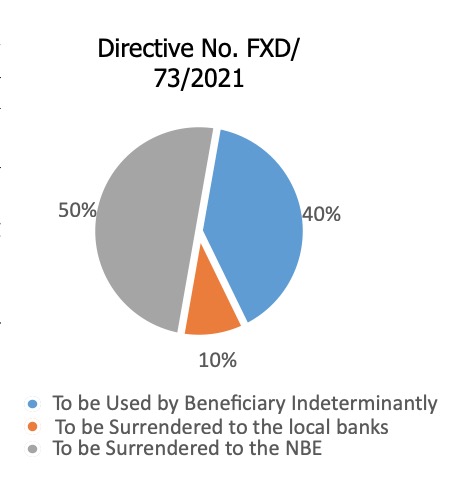

Effective from 01 September 2021, NBE repealed Directive No. FXD/70/2021 and issued Directive No. FXD/73/2021 governing the retention and utilization of foreign currency earnings from export and inward remittance. This Directive introduced 50% - 40% - 10% allocation requiring exporters and remittance earners to surrender 50% of their total earnings to NBE, permitted the account holders to retain 40% of the foreign currency earning indefinitely and sale the remaining 10% to the commercial banks.

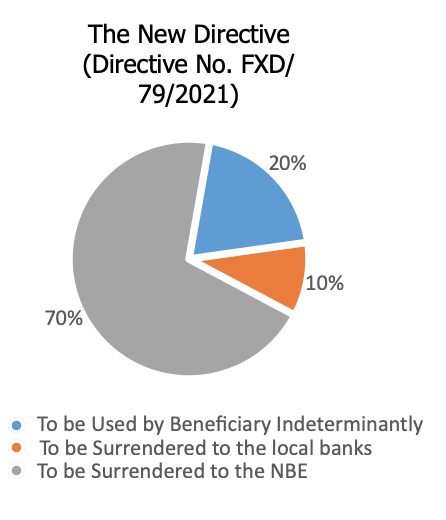

Directive No. FXD/73/2021 is a short lived one as NBE replaced it by a New Directive (Directive No. FXD/79/2021(“New Directive”)) that takes effect from 06 January 2022. The basic changes introduced by this New Directive are:

Total surrender amount is increased: Under the New Directive, exporters and inward remittance earners are required to surrender 70% of their total earnings to NBE. Previously, exporters and inward remittance earners were required to surrender 50% of their total earnings to NBE.

Total surrender amount is increased: Under the New Directive, exporters and inward remittance earners are required to surrender 70% of their total earnings to NBE. Previously, exporters and inward remittance earners were required to surrender 50% of their total earnings to NBE.

Amount of proceeds to be retained is significantly decreased: Under the Old Directive, retaining 40% of the total foreign currency earning for indeterminate period of time in a retention account was permitted after deduction of the 50% surrender requirement. The remaining 10% of foreign currency amount was required to be surrendered to the respective commercial banks based on the prevailing exchange rate and using the buying rate. Under the New Directive, the amount of foreign currency to be surrendered has increased significantly. Commercial banks are required to surrender 70% of the total foreign currency earning from export and remittance earnings to the NBE. The remaining 10% of the foreign currency amount is required to be surrendered to the respective commercial banks based on the prevailing exchange rate and using the buying rate.

Simply put, the New Directive changed the allocation to 70% - 20% - 10% (70 percent to NBE, 20 percent to the retention account for the benefit of exporters and inward remittance earners and 10 percent to commercial banks).

Simply put, the New Directive changed the allocation to 70% - 20% - 10% (70 percent to NBE, 20 percent to the retention account for the benefit of exporters and inward remittance earners and 10 percent to commercial banks).

Disclaimer: This information is intended as a general overview and discussion of the subjects dealt with. The information provided here was accurate as of the day it was posted; however, the law may have changed since that date. This information is not intended to be, and should not be used as, a substitute for taking legal advice in any specific situation. Mehrteab Leul & Associates is not responsible for any actions taken or not taken on the basis of this information. Please refer to the full terms and conditions on our website.

Copyright©2022 Mehrteab Leul & Associates. All rights reserved.

Key Changes Introduced by the Amendment of the Federal Income Tax Regulation No. 410/2017

Introduction

The Council of Ministers has amended some provisions of the Federal Income Tax Regulation No. 410/2017 (“Regulation”) on September 23, 2021. The amendment was said to be necessitated by the reason that some provisions of the Regulation lack clarity and impacted economic transactions. The amendment (“Amendment”) has the aim of enabling the tax authority collect taxes by resolving the disagreement between the tax authority and taxpayers caused by lack of clarity on the Regulation. It has also the aim of increasing the flow of investment through amending those provisions that adversely impact investment. We have summarized the basic changes introduced by the Amendment as follows:

Depreciation allowance is permitted for lessees in a hire-purchase arrangement

Under the Capital Goods Business Proclamation No, 103/1998, three types of capital goods leasing are recognized i.e. finance lease agreement, operating lease and hire-purchase lease agreements. The Regulation provides a uniform treatment for all kinds of lease arrangements whereby the rent paid by the lessee would be a deductible expense. However, given the fact that in a hire-purchase arrangement, the lessee would be the owner of the leased property after settling all the rent, the Amendment permits these lessees to have depreciation allowance on the leased property instead of treating the rent as a deductible business expenditure.

No depreciation allowance is permitted for a building which is not completed even though partially used as a business asset

The provision of Article 40 of the Regulation was ambiguous in relation to allowing depreciation for buildings partially used as a business asset. The Amendment makes it clear that only buildings that are completed would be entitled to a depreciation allowance in proportion to the portion of the building used as a business asset, if the buildings are used partially as business assets and partially for other purposes.

Loss-carry forward benefit is applicable only if the taxpayer has a taxable income

The Amendment has provided that if the taxpayer has incurred a loss for more than one tax year, the loss of the earlier year must be deducted first. In this regard, the loss will be deducted only if the taxpayer has a taxable income. The loss cannot also be forwarded beyond a period of five years.This is apparently aimed to resolve the contention that a taxpayer who has incurred a loss for more than one year must be entitled to a loss carry-forward privilege for a period of more than five years.In addition, the Amendment has endowed the Ministry of Finance the discretion to allow a third loss suffered by a taxpayer engaged in the manufacturing sector to be carried forward when it believes that there is good cause for doing so.

The treatment of foreign exchange loss has been changed

The Regulation used to provide that if a taxpayer has incurred a foreign currency exchange loss, this loss would only be offset against a foreign currency exchange gain derived by the taxpayer. However, this provision was found to be problematic as most investors and business entities usually do not come across a foreign currency gain. The Amendment changed this and provided that if the foreign exchange loss was sustained in relation to the purchase of capital goods, the loss will be added to the cost of the capital good to be used as a basis for calculation of depreciation. On the other hand, when the loss is incurred for operating expenses, the loss will be considered as a deductible expenditure for the tax year.

Adjustment of Inflation is permitted for shares and bonds in the calculation of capital gains tax

Under Ethiopian income tax law, transfer of immovable properties and shares bonds is subject to Capital Gains Tax. In calculation of such tax, the Regulation allowed inflation adjustment to be made only in respect of the transfer of immovable assets. Now, under the Amendment, inflation adjustment is also permitted to be made to the cost of shares and bonds.

Continued application of the previous Income Tax Proclamation No. 286/2002 for losses carried forward under the same Proclamation

There were occasional arguments on part of some taxpayers that they should be entitled to a new set of loss-carry forward privilege after introduction of the currently applicable Income Tax Proclamation in substitution of the old one. But the Amendment now provides that taxpayers who have carried forward two losses under the previous Income Tax Proclamation will not be entitled to carry-forward any further losses under the new Income Tax Proclamation. If the taxpayer has any loss that should be carried forward under the repealed Proclamation, the loss carry forward will be treated under that law. This means, if the taxpayer has carried forward a loss for one tax year under the repealed proclamation, it will be entitled to carry the remaining loss forward in accordance with the repealed Proclamation. This is to emphasize that the taxpayer is entitled for a loss-carry forward privilege for not more than two losses sustained in its lifetime.

Retroactive application of the Amendment

The Amendment is made to be applicable to outstanding tax disputes and controversies that have not yet been resolved. Accordingly, all tax arrears that emanate from the aforementioned amendments would be settled in accordance with the Amendment.

Disclaimer: This information is intended as a general overview and discussion of the subjects dealt with. The information provided here was accurate as of the day it was posted; however, the law may have changed since that date. This information is not intended to be, and should not be used as, a substitute for taking legal advice in any specific situation. Mehrteab Leul & Associates is not responsible for any actions taken or not taken on the basis of this information. Please refer to the full terms and conditions on our website.

Copyright©2021 Mehrteab Leul & Associates. All rights reserved.

Seedlings Planting

MLA is pleased to announce its seedlings planting initiative with focus on post planting care for the seedlings. With the shared view of building responsibly grounded business in Ethiopia, MLA is proud to collaborate with its valued corporate clients in this noble imitative.

Legal Update: Highlights Of Key Changes And Introductions Made By The New Arbitration And Conciliation Proclamation

INTRODUCTION

Ethiopia did not have an independent piece of legislation that regulated the manner in which alternative means of settling disputes operate. It was only the Ethiopian Civil Procedure Code and the Ethiopian Civil Code (“Previous Laws”), together with other scattered provisions in various laws, which used to regulate arbitration and conciliation for over half a century. These laws provided for basic frameworks of conducting arbitration and conciliation such as governing the arbitration agreement, manner of composition of tribunals, and the arbitration award. However, these laws were criticized for failing to sufficiently address, among other things, the manner of establishment and operation of arbitration centres, identifying arbitrable and non-arbitrable matters, providing a limitation on the role of courts during the arbitration proceeding, the appealability of arbitration awards and the competency of the arbitration tribunal to decide on its own jurisdiction. The provisions under the Previous Laws are also highly incompatible with the internationally recognized principles of commercial arbitration.

The dispute settlement mechanism prevailing in the country is litigation, more than any other, as the litigation system is characterised by protracted lawsuits that take years to resolve a matter. This has inevitably resulted in a congested court environment. However, this system does not go along with the very nature of commerce for which time, predictability and confidentiality are of the essence; features which are not exhibited in the Ethiopian litigation system.

As part of the recent legislative reform the country is undertaking, the Ethiopian House of People’s Representatives recently ratified the new Arbitration and Conciliation Proclamation No.1237/2021 (the “Proclamation”). The Proclamation entered in to force on 02 April 2021. It basically repealed and replaced Articles 3318-3324 of the Civil Code, which governed conciliation, and Articles 3325 to 3346 of the Civil Code, which governed arbitration. The provisions of the Civil Procedure Code from Articles 315 to 319 and Articles 350, 352, 355-357 and 461, which deal with arbitration, have also been repealed by the Proclamation.

With the aim of complementing the right to justice and to contribute to the resolution of investment and commercial disputes and to the development of the sector, the Proclamation recognized the fact that arbitration and conciliation help in rendering efficient decisions by reducing the cost of the contracting parties, protecting confidentiality, allowing the participation of experts and the use of simple procedure which provides freedom to contracting parties. It also aims to provide for a general framework for the identification of arbitrable cases, management of arbitration proceedings and execution of those decisions that fit the prevailing reality of Ethiopia. By amending the existing laws, the Proclamation aims to be in line with the international principles and practice and support the implementation of international treaties.

Under this piece of MLA’s Legal Update, we will highlight the key changes and introductions made by the Proclamation as follows.

ARBITRATION

Scope of Application: The Proclamation regulates arbitration and conciliation modes of dispute settlement. It is primarily applicable to commercial related national arbitrations, international arbitrations with a seat in Ethiopia or outside Ethiopia and national conciliation proceedings. The Proclamation is also applicable when one of the contracting parties is situated in Ethiopia and where the place of arbitration is not designated.

Definition of International Arbitration: Unlike the Previous Laws, the Proclamation provides a clear and exhaustive definition of what international arbitration constitute. The arbitration would be considered as international when the parties agreed, in express terms, that the subject matter of the arbitration agreement relates to more than one country, when the principal business of the contracting parties is in two different countries at the time of conclusion of contract, where the chosen place of arbitration or the place of performance or the place of business of the subject matter of the dispute arises or is closely connected with a foreign country. Defining international arbitration is relevant to determine the applicable substantive laws and to ensure the independence of a sole-arbitrator who shares nationality with one of the parties to the arbitration.

Prohibition of Court Intervention: As a basic departure from the Previous Laws, the Proclamation introduced a prohibition on the intervention of courts in the arbitration proceeding. The Proclamation specifically mentions some exceptions where the courts may intervene in the arbitration proceeding.

Electronic Arbitration Agreement: In line with the Electronic Transaction Proclamation No.1205/2020 and other laws that recognize electronic communications as a valid means of creating a contract, the Proclamation recognizes that an arbitration agreement can be made by the parties to the contract using electronic communication. Electronic agreements include agreements made through electronic media and accessible for subsequent use.

Definition of Non-Arbitrable Matters: As another basic departure from the Previous Laws, the Proclamation contains an illustrative list of matters which are not subject to arbitration. Previously, it was not clear which matters are arbitrable and which are not. Matters relating to family such as divorce, adoption, guardianship, tutorship and succession cases, criminal matters, tax matters, judgement on bankruptcy and dissolution of business organizations, land matters, administrative contracts unless permitted by law, trade competition and consumer protection related matters, administrative disputes and other matters made non arbitrable by other laws are not arbitrable matters under the Proclamation and the parties cannot agree to settle those disputes by way of arbitration. In fact, the Civil Procedure Code used to take administrative contracts out of arbitration agreement and this is maintained under the Proclamation.

Applicable Substantive Law: The Proclamation gives freedom to the parties when choosing the applicable substantive law. However, in the case when the arbitration seat is in Ethiopia, the applicable substantive law will also be Ethiopian law when the parties have not chosen the applicable law.

Composition of Arbitration Tribunals: the Proclamation has regulated the number of arbitrators, appointment of arbitrators and the rights and obligations of arbitrators in a more extensive manner than what was provided under the Civil Code. The parties are free to determine the number of arbitrators, but it must always be odd in number, and the manner of appointment of arbitrators has also been regulated. Foreign arbitrators can also be appointed by the parties to arbitrate disputes. The Proclamation also defined the rights and obligation of the arbitrators and set out some prohibitions such as individual meeting with the party or receiving gifts. An objection against the appointed arbitrators can be made by the parties to the tribunal and in case the objection is rejected by the tribunal, the matter can be referred to a court.

Removal of an Arbitrator; under the Civil Code, parties who want to remove an arbitrator owing to his default to discharge the obligations may request a court for the removal of arbitrators. Under the Proclamation, removal of an arbitrator can be done by the agreement of the parties in the event when the arbitrator failed to discharge his obligation. The parties are required to notify the tribunal for the latter to take a measure for the removal. Any grievance by the parties relating to the decision of the tribunal on the removal of an arbitrator is appealable to the Federal First Instance Court.

The Establishment of Arbitration Centres: The other new introduction is that the Proclamation permits the establishment of arbitration centres by government authority or private persons. The Federal Attorney General is empowered to license and supervise arbitration centres and set a criterion for their establishments without affecting the operation of existing centres.

The Recognition of the Kompetenz-Kompetenz Principle: The Proclamation recognizes that the arbitration tribunal designated by the parties have a power to determine the existence or nonexistence of a valid arbitration agreement and whether the tribunal itself has a jurisdiction to preside over the matter. To this effect, the Proclamation recognizes that the arbitration agreement will remain operational irrespective of the fact that the main contract becomes null and void. This limits an ill intended party from bringing the matter before courts by objecting the jurisdiction of the tribunal. It is only after the decision of the tribunal on its own jurisdiction that the party may bring the matter before Federal First Instance Court. Under the Civil Code, only the contracting parties are expected to authorise the arbitrator to decide disputes pertaining to jurisdiction.

The Taking of Interim Measures by the Tribunal: The other major departure of the Proclamation is that it expressly permits arbitration tribunals to take an interim measure and provides the conditions under which the measures can be issued. Upon the consent of the parties or on its own initiative, the Tribunal is authorised to take various preventive interim measures such as rendering decisions that properly preserve and maintain goods in dispute or assets and finds that on which an arbitration decision may be given. Any interim measure provided by arbitrators are binding in Ethiopia regardless of the place where the measure was issued. The parties are also free to require the court for the issuance of interim measures.

Proceedings of the Arbitration: the Previous Laws used to provide that the procedure of arbitration needs to be as near as the procedure of a civil court. The Proclamation deviated from this and has established the manner of setting the arbitration proceeding in motion, the service of arbitration notice, statement of claim and summon and their respective timing. The Proclamation also recognized the equal treatment of the parties in the arbitration proceeding, their freedom to determine the applicable procedural law and language of the arbitration. The manner of setting in motion the arbitration proceeding is by a notice to be submitted by the plaintiff and the manner of serving the notice to the other party is clearly regulated, which was not the case under the previous laws. The plaintiff is also expected to present a statement of claim with all the supportive evidences and the defendant shall bring a response for the allegations. The oral proceeding follows the written arguments which is discretionary to the tribunal. The tribunal may even request expert opinion on a particular issue of fact and it may also request for the support of a court in receiving evidence.

Arbitral Awards: the tribunal is expected to apply Ethiopian substantive law for resolving the dispute. If there are no such agreements, the tribunal has the jurisdiction to apply a law relevant to the matter. The Proclamation regulated the form and content of the arbitral award. Even after making the award, the tribunal is authorized to make the necessary correction on minor errors, provide interpretation or render an additional decision that is based on the application of one of the parties or on its own initiative.

Objection to and Appeal from the Arbitral Award: The Proclamation permits any third party whose interest has been affected by an arbitral award to lodge an objection against the award to the relevant court with a jurisdiction within 60 days. In principle, the Proclamation does not allow an appeal from the award unless parties agreed otherwise. However, unless the parties agreed otherwise, the parties are free to lodge an appeal to the Cassation Division when there is fundamental error of law.

The Setting aside of Arbitration Award: The Proclamation recognized the manner in which an arbitration award can be set aside. There is exhaustive list of grounds in which a court may set aside the arbitration award. This includes the incapacity of the parties to arbitration, the arbitration agreement becoming null and void, one of the parties not having an equal right to participate in the proceeding, when the arbitrators received a bribe or acted in a way that affected their independence and impartiality or when the tribunal acted without having jurisdiction or exceeded what transpired under the arbitration agreement.

Recognition and Execution of an Arbitral Award: As a principle, the Proclamation underlines that an arbitral award rendered in Ethiopia or abroad will be executed on the basis of the Civil Procedure Code as though the decisions were rendered by a court. An objection to the enforcement of an award can be made by a party on grounds that are similar with those grounds for setting aside the arbitration itself. With regards to foreign arbitral awards, the United Nations Convention on the Recognition and Enforcement of Foreign Arbitral Awards to which Ethiopia is a party would be applicable as long as the arbitral awards fall under the Convention. However, the Proclamation lists grounds by which a foreign arbitral award may not be enforced, which are similar in essence with the requirements provided under the Civil Procedure Code.

CONCILIATION

The Proclamation also regulates matters relating with conciliation. It defines conciliation as a process of dispute settlement that is facilitated by a third party designated by contracting parties in order to resolve existing or future disputes. The conciliator will be appointed by the parties themselves.

The Civil Code had only 7 provisions with regards to conciliation, while the Proclamation has become more elaborative and has 26 provisions. The basic new introductions are:

- A conciliation agreement that is validly made can be brought before a court as a preliminary objection;

- The Proclamation governs the formal process of initiating the conciliation proceeding, which is by the request of one party and the acceptance by another;

- The Proclamation provides the number of conciliators to be one, unless the parties agreed otherwise;

- The roles of the conciliator are expanded, authorising the conciliator to summon witnesses, hear expert opinion or conduct other activities. It also entrusts the conciliator to forward a proposal for conciliation;

- The Proclamation also provides that the conciliation proceeding is not required to be bound by any substantive or procedural laws;

- The Proclamation recognizes that a conciliation agreement shall remain confidential;

- It also allows parties to request an interim measure from courts while the conciliation proceeding is pending;

- When the parties agreed to the proposal of the conciliator, the conciliator will prepare a settlement agreement to be signed by the parties. Once the settlement agreement is drawn and agreed, it constitutes a final and non-appealable decision on which an application for execution can be submitted with a court of jurisdiction;

- The Proclamation permits parties to resort to court or arbitral proceedings when the conciliator failed to perform their obligations within the time agreed or within six months, if no time is set, or it provides a written declaration confirming that the dispute cannot be resolved through conciliation;

- One of the parties may apply to a court for the invalidation of the settlement agreement provided that the settlement agreement is null and void, lacks clarity, is contrary to public policy and peace, or the parties lack capacity to conclude the agreement;

- The Proclamation also introduced basic prohibitions and limitations. For example, the conciliator cannot serve as an arbitrator, attorney, or agent, or be a witness in any judicial or arbitration proceeding on a similar matter he handled as a conciliator. The suggestion forwarded or an admission made by one of the parties or a settlement proposal of the conciliator in the conciliation proceeding are inadmissible in judicial or arbitral proceedings; and

- With a bid to encourage parties to resolve their dispute through conciliation, the Proclamation offered the reimbursement of court fees paid by parties while instituting a court case when they have resolved their dispute withdrawing the court suit.

Disclaimer: This information is intended as a general overview and discussion of the subjects dealt with. The information provided here was accurate as of the day it was posted; however, the law may have changed since that date. This information is not intended to be, and should not be used as, a substitute for taking legal advice in any specific situation. Mehrteab Leul & Associates is not responsible for any actions taken or not taken on the basis of this information. Please refer to the full terms and conditions on our website.

Copyright©2021 Mehrteab Leul & Associates. All rights reserved.

Coronavirus COVID-19: Legal guidance for employers in Ethiopia

|

New Excise Tax Proclamation, Legal Update

The Excise Tax Proclamation No. 307/2002 (Previous Proclamation) that had been in effect since 2003 has been repealed. The Ethiopian Parliament has approved a new Excise Tax Proclamation No. 1186/2020 (New Proclamation) on 13 February 2020. Below we provide a summary of the major changes introduced by the New Proclamation.

Scope

The scope of application of the New Proclamation is on excisable imported goods and those manufactured in Ethiopia by licensed manufacturers. Excisable goods are those itemised in a Schedule attached to the Proclamation which currently lists 19 classes of goods and 378 specific items classified under each of the classes.

Registration and licensing by the tax authority

The New Proclamation has introduced a system by which all producers and suppliers of excisable goods have to be mandatorily registered and licensed by the Tax Authority for production and supply of excisable goods and services in Ethiopia and engagement in activities subject to the licensing in a Directive to be prescribed by the Ministry of Finance.

Tax rates

The New Proclamation has introduced the application of a specific excise tax rate that is based on the quantity or weight of goods along with an Ad Valorem rate (i.e. based on percentage of value) as opposed to the Previous Proclamation which adopts only the latter type of excise tax rate. Ad Valorem rates range from a minimum of 5% (e.g. rubber tyre) to a maximum of 500% (most used vehicles with a cylinder capacity exceeding 1800 cc and aged more than seven years). Specific rates are adopted for goods such as beer (in which specific and ad valorem rates apply alternatively, whichever is higher) and cigarettes (in which a combination of both rates apply).

The Ministry of Finance is empowered to increase or decrease the Excise Tax Rate up to a maximum of 10% of the rate indicated under its first Schedule. In order to cater for inflation, the Tax Authority is given the responsibility to apply an inflationary adjustment at least once a year on the Standard Excise Tax Rates according to a Directive to be issued by the Ministry of Finance.

Tax base and time of payment

As a significant shift from the Previous Proclamation, the tax base for goods produced locally is now the factory selling price. This is the price paid by the purchaser or the fair market value of the goods in case of related party transactions less the applicable VAT on supply of goods, the cost of Excise Stamp and the cost of returnable packaging. Excise tax must be shown separately on the transactional invoice.

For imported goods, the tax base is the value of goods to be determined as per the Customs Proclamation plus the applicable Customs Duty payable on the goods.

For goods manufactured locally, the time of exit of goods from factory or their consumption therein determines the time of payment of the tax. On the other hand, the time of entry of goods into Ethiopia is when the tax must be paid for imported goods with the exception of petroleum products in which the Ministry of Finance could give special permits to change such time.

Exemption, refund and deduction

The New Proclamation introduces elements the fulfilment of which renders goods not excisable. It also lists situations and items that are exempt from the payment of Excise Tax. Excisable goods exported or sold to persons with a tax free privilege, excisable goods destroyed by the producer following the Tax Authority’s approval and excisable goods lost or destroyed by accident or other factors beyond one’s control are exempt items in the New Proclamation. The Ministry of Finance is also given the power to exempt goods from the tax due to economic, social and administrative reasons.

The New Proclamation has also introduced a mechanism by which an Excise Tax that is already paid to the Government could be refunded to the taxpayer based on occurrence of certain events such as loss or destruction of goods or their return to the seller by the purchaser.

The deduction of Excise Tax paid on inputs is also allowed for a local manufacturer of all excisable goods save for alcohol, tobacco and sugar.

A monitoring mechanism on excisable goods

The New Proclamation has introduced a monitoring mechanism of excisable goods by the Tax Authority while excisable goods are inside the manufacturing factory of an authorised producer. Accordingly, an officer of the Tax Authority is empowered to investigate the nature and status of excisable goods, to weigh their weights, and count their quantity inside the factory. Authorised manufacturers of excisable goods are in turn obliged to register list of inputs and outputs in an approved form and set up a mechanism by which the officer of the Tax Authority can realise its monitoring responsibilities.

Excise tax stamp

The New Proclamation empowers the Ministry of Finance to issue a Directive that governs stamps that are to be used to identify excisable goods, alcohol products that are exempt from the tax, export goods and those goods produced for the consumption of exempt entities. The time, place and manner of administration of such excise tax stamps is also to be addressed in this Directive. The type and content of the excise tax stamps is to be publicized by the Tax Authority in newspapers having nationwide circulation.

New excisable items and changed tax rates

The other major change introduced by the New Proclamation is the levying of the tax on items that were not excisable under the applicable excise tax law and change of the tax rate on already excisable goods.

The new excisable goods include fats and oils, foods containing sugar, chocolates and cacao products, fireworks, plastic bags, plastic vehicle tyres, artificial flowers and fruits, human and synthetic hair, tractors, special purpose vehicles, trailers, gambling and video game machines are among the newly introduced excisable items.

Penalties

The manufacturing and importation of excisable products without having the appropriate license results in an administrative penalty amounting to double of the excise tax that would have been payable. Fines ranging from ETB 50,000 – 200,000 and imprisonment ranging from a minimum of three to a maximum of seven years are also included as criminal penalties in the New Proclamation for offences committed in violation of the different mandatory provisions of the law. Such administrative and criminal liabilities are in addition to those already provided in the Tax Administration Proclamation unless provided in an overlapping manner, in which case the New Proclamation applies.

Effective date

No effective date is specified and the President of Ethiopia has not signed in the copy of the New Proclamation that was circulated by the Ministry of Revenues. Nonetheless, the Ministry of Revenues circulated the copy with a notice to taxpayers stating that the New Proclamation will take effect beginning from the 14 February 2020, a day after the approval of the Proclamation in the Parliament.

Normally and in the absence of a relevant rule in the law itself, new laws that have been approved by the Ethiopian Parliament – the House of Peoples Representatives, begin to take effect when they are published in the nation’s official publication, the Federal Negarit Gazeta. Article 57 of the Federal Constitution of Ethiopia provides that laws passed by the Parliament must be signed by the President of Ethiopia within fifteen days and it is if the President fails to sign the law within such period that the law will take effect without his/her signature.

Leaving the above controversy on the New Proclamation’s effective date aside, there is a grace period of six months for persons engaged in manufacturing of excisable goods to continue manufacturing without having the appropriate license as indicated above. In addition, those goods for which a letter of credit has already been opened before issuance of the New Proclamation and those goods imported into Ethiopia within six months from entry into force of the New Proclamation will be excised based on the Previous Proclamation.

(MoF) approved tax-free on agricultural mechanizations

The Ministry of Finance (MoF) approved the import of agricultural mechanization, irrigation and animal feed technologies, and equipment to be tax-free. https://lnkd.in/dMM9Kmi

Recognized by the Legal 500 as a Tier one firm

Mehrteab Leul and Associates Law Office (MLA) is pleased to be recognized by the Legal 500 as a Tier one firm in Ethiopia. We believe the ranking accurately reflects our first-rate legal services.

Congrats to all DLA Piper Africa Tax Team!

Our very own Mehrteab leul Kokeb Tadesse Lencho and Sisay Habte are members of the tax team who won the African Transfer Pricing Team of the year last night at the International Tax Review awards. Congrats to all DLA Piper Africa Tax Team!