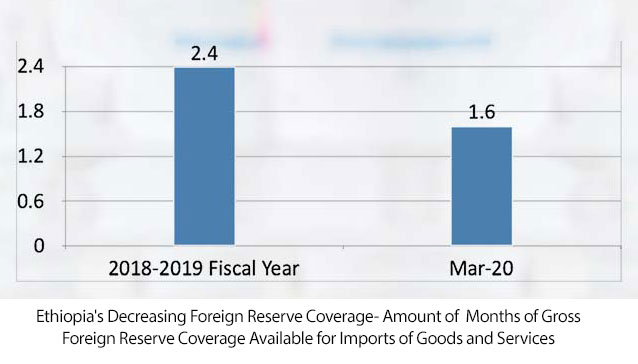

As an institution that seeks to foster a healthy financial system as well as facilitate the rapid economic development of the country, the National Bank of Ethiopia (the “NBE”) has the power to formulate and implement those exchange rate policies that can help create a strong and stable economy. Whether it is by monitoring the foreign exchange transactions of banks, establishing the terms and conditions for foreign exchange transfers, or identifying those economic sectors that warrant the prioritized allocation of foreign currency, the role of the NBE in ensuring the efficient allocation of this important yet scarce resource cannot be overstated. This is particularly true in 2020, where the growing spread of the Novel Coronavirus and the troubling desert locust infestation has necessitated the reprioritization of Ethiopia’s decreasing foreign reserve coverage.

It is in this context that the new Transparency in Foreign Currency Allocation and Foreign Exchange Management Directives (“Directives No. FXD/67/2020”) came into effect in 05 October 2020. In doing so, there are some notable differences between Directives No. FXD/67/2020 and the Transparency in Foreign Currency Allocation and Foreign Exchange Management (as Amended) (“Directives No. FXD/62/2019”), particularly when it comes to how banks prioritize, allocate and utilize their foreign currency reserves. As such, this legal update seeks to assess the NBE’s recently issued Directives No. FXD/67/2020 in light of the previous Directives that regulated the allocation and management of foreign currency in Ethiopia.

It is in this context that the new Transparency in Foreign Currency Allocation and Foreign Exchange Management Directives (“Directives No. FXD/67/2020”) came into effect in 05 October 2020. In doing so, there are some notable differences between Directives No. FXD/67/2020 and the Transparency in Foreign Currency Allocation and Foreign Exchange Management (as Amended) (“Directives No. FXD/62/2019”), particularly when it comes to how banks prioritize, allocate and utilize their foreign currency reserves. As such, this legal update seeks to assess the NBE’s recently issued Directives No. FXD/67/2020 in light of the previous Directives that regulated the allocation and management of foreign currency in Ethiopia.

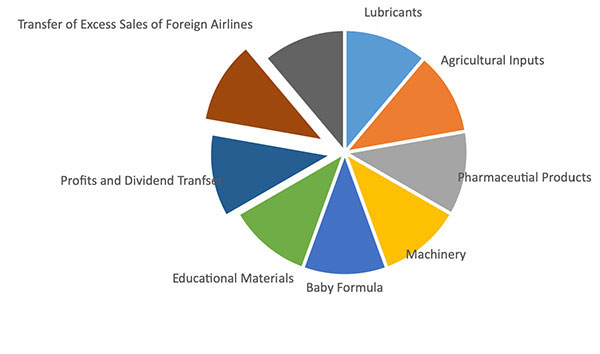

One important change brought about by Directives No. FXD/67/2020 is the downgrading of particular payments that Directives No. FXD/62/2019 not only considered to be important for foreign investors but also economically essential; warranting the prioritized allocation of foreign currency. In downgrading profit and dividend transfers as well as the transfer of excess sales of foreign airlines from Second Priority payments to Third Priority payments, the NBE has reverted to its 2018 position of considering these payments less of a priority than those other goods and payments listed in 6.1(a) and 6.1(b) of the Directive.

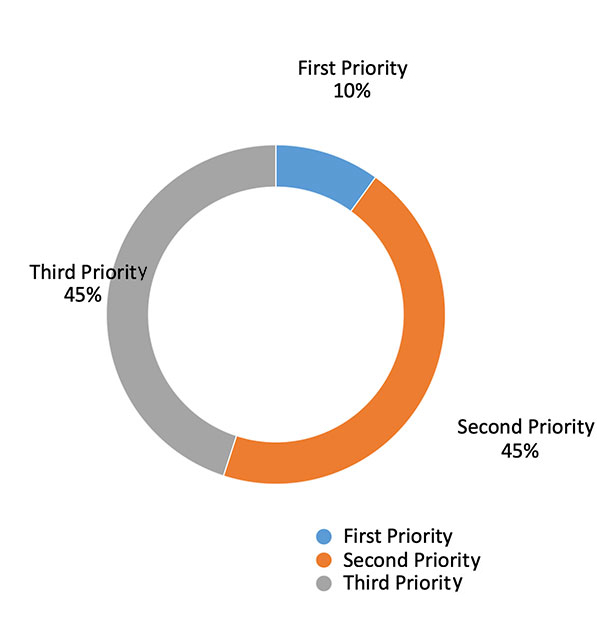

Although the recently enacted Investment Proclamation No. 1180/2020 states that any foreign investor has the right to not only remit the profits and dividends accruing from their investment but also those proceeds from the sale of the business or the transfer of shares, Directives No. FXD/67/2020 will likely make such transactions lengthy as the allocation of foreign currency is not only based on prioritized categories but also on a first come first serve basis. As such, even though Directives No. FXD/67/2020 requires banks to allocate 45% from half of their foreign currency reserves for all imports of goods and services to Third Priority imports and payments, the NBE’s first come first serve policy as well as the fourteen other payments and imports in this category will likely result in the diminished availability of funds for these two important transactions.

Although the recently enacted Investment Proclamation No. 1180/2020 states that any foreign investor has the right to not only remit the profits and dividends accruing from their investment but also those proceeds from the sale of the business or the transfer of shares, Directives No. FXD/67/2020 will likely make such transactions lengthy as the allocation of foreign currency is not only based on prioritized categories but also on a first come first serve basis. As such, even though Directives No. FXD/67/2020 requires banks to allocate 45% from half of their foreign currency reserves for all imports of goods and services to Third Priority imports and payments, the NBE’s first come first serve policy as well as the fourteen other payments and imports in this category will likely result in the diminished availability of funds for these two important transactions.

Another notable change brought about by Directives No. FXD/67/2020 is its specificity on who can request for special priority allocation of foreign currency. Whilst Directives No. FXD/62/2019 merely stated that the Governor or Vice Governor of the NBE may give special priority approval on a case by case basis, Directives No. FXD/67/2020 limits the discretion of both the Governor and Vice Governor by listing financial institutions, the federal government, regional governments, and city administrations as those that can request for special priority.

Although it is possible to infer from Directives No. FXD/67/2020 that financial and governmental institutions have supplanted investors when it comes to making such special requests, it is important to note that most of the essential imports are still prioritized for foreign exchange allocation. For example, pharmaceutical goods such as medicine and laboratory reagents continue to be classified as first priority essential goods that banks are now mandated to allocate 10% of their foreign currency reserves to.

Similarly, inputs for agricultural and manufacturing investments are still designated as secondary priority imports, making access to foreign currency relatively easier for those investors that wish to purchase and import fertilizers, seeds, and pesticides as well as manufacturing chemicals and raw materials. With Directives No. FXD/67/2020 also entitling bank presidents to approve the import of spare parts for those faulty machinery that can disrupt production, it is our opinion that Directives No. FXD/67/2020 is more supportive of the manufacturing and agricultural sectors than the Directive it repealed.

Furthermore, foreign investors are already exempted from the registration process that underpins this priority scheme, as they are still afforded foreign exchange on demand for some of their fiduciary interests. Whether it is the repayment of the principal interest or fees of external debt obligations, the payment of suppliers’ credit, the repatriation of salary by foreign employees, or fees related to consultancy, commissioning and royalties, neither the limitation placed on special priority requests nor the de-prioritization of certain payments will hinder their ability to fulfill their fiduciary responsibilities to their creditors as well as their employees.

Furthermore, foreign investors are already exempted from the registration process that underpins this priority scheme, as they are still afforded foreign exchange on demand for some of their fiduciary interests. Whether it is the repayment of the principal interest or fees of external debt obligations, the payment of suppliers’ credit, the repatriation of salary by foreign employees, or fees related to consultancy, commissioning and royalties, neither the limitation placed on special priority requests nor the de-prioritization of certain payments will hinder their ability to fulfill their fiduciary responsibilities to their creditors as well as their employees.

In conclusion, the enactment of Directives No. FXD/67/2020 will likely make payments related to profit and dividend transfers as well as the transfer of excess sales of foreign airlines a lengthy process as the allocation of foreign currency is not only based on prioritized categories but also on a first come first serve basis. However, Directives No. FXD/67/2020 still affords foreign investors the right to obtain foreign exchange on demand for some of their most essential fiduciary responsibilities.

Disclaimer: This information is intended as a general overview and discussion of the subjects dealt with. The information provided here was accurate as of the day it was posted; however, the law may have changed since that date. This information is not intended to be, and should not be used as, a substitute for taking legal advice in any specific situation. Mehrteab Leul & Associates is not responsible for any actions taken or not taken on the basis of this information. Please refer to the full terms and conditions on our website.

Copyright©2020 Mehrteab Leul & Associates. All rights reserved.